Due to recent political events, the EU, US and their allies are seeking to remove Russia from the global payment messaging system, i.e., SWIFT, as a way to imposing economic and financial sanctions on Russia. Based in Belgium, SWIFT facilitates monetary transactions among more than 11,000 banks and financial institutions across the globe, making it a critical component in the international cross-border payment system, or simply put, a “world financial artery”.

Why SWIFT Matters To Russia?

Russia, as the largest natural gas-exporting country in the world, is heavily reliant ton the SWIFT system for is key gas exports. Removing Russia from the SWIFT system is an economic nuclear bomb. When Iran was cut out of SWIFT in 2012, it lost 30% of its foreign trade. 862 individual SWIFT codes that originate from Russia represent around around 300 Russian banks and financial institutions. While removing those 300 banks from the 11,000 bank network might not seem like a big deal for the system itself, but it would prohibit those institutions from using the well established system to facilitate cross-border transfers. Anyone who wants to purchase natural gas with Russian companies will have to arrange a channel outside of SWIFT, which would be costly, slow and even insecure.

Yet, something is different from the past

SWIFT sanctions reveal that the US dollar is still the dominant of the international financial system. Yet, at the same time, the international communities began to question who give the small circle of the world powers the right to weaponise the SWIFT? This kind of sanction is actually a lose-lose choice. Ever since the emergence of blockchains and cryptocurrencies, people in the world started to embrace the concept of “decentralization”. From bitcoin to thousands of other cryptocurrencies currently on chain, the popularization of crypto brought a paradigm shift of what we see “value” from the “centralized” reality to the “decentralized” blockchain-verse.

When the SWIFT became a weapon in economic sanctions, it calls for an alternative cross-border payment system that are free from political control, human manipulation, and most importantly, structurally decentralized. With blockchain technology, transaction records are transparent and open to everyone, not just to banks or governments; we no longer need to establish trust before making a transaction, but to believe in the trust-less “decentralized” blockchains. Thus a cross-chain payment system, not just an average bridge, which should have the potential to become the “SWIFT” for blockchain-verse, is desperately in needed to make the digital assets payment system a true borderless universe.

Which one can become the cross-chain payment system?

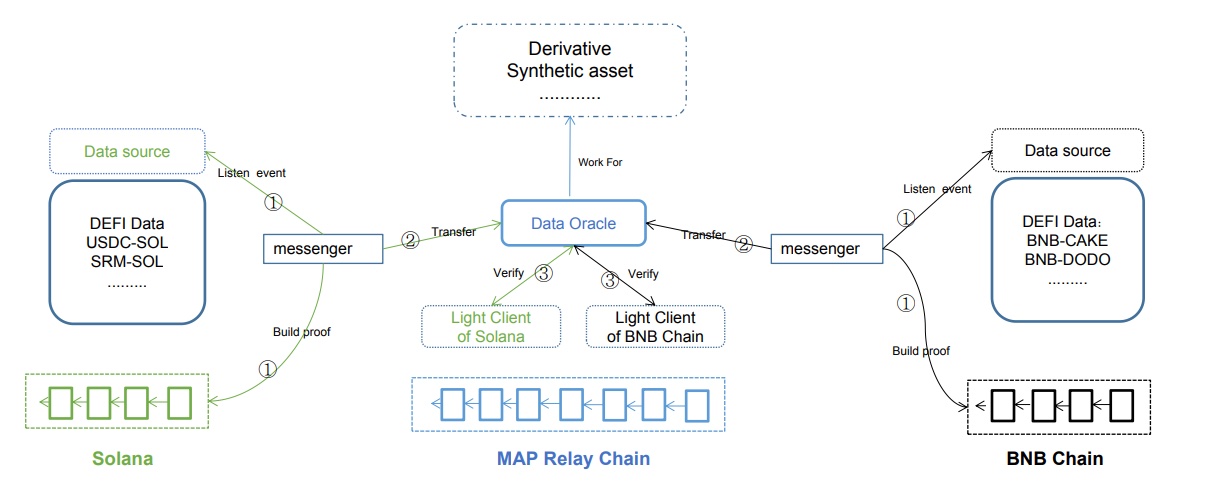

Currently, there are lots of cross-chain bridges that can connect to different blockchains and transfer digital assets. However, and the operating mechanism of those bridges are still partially centralised, i.e. controlled by a group of super administrators. This invites human error and security risks. There had been multiple exploits on cross-chain bridges with billions of dollar worth cryptocurrencies were stolen. For example, the architecture of THORChain and Multichain is in the form of cold wallet MPC (Multi-Party Computation) custody. Although MPC is based on multi-sig, it is still controlled by the person (a group of people) designated by the bridge project. The custody and contracts of users’ cross-chain assets are at the hand of a small circle of centralized cold wallets. Sounds familiar? Remember, placing trust in a centralised authority defeats the purpose of using blockchain. Current bridges are too centralized and will not stand the test of time.

Ultimate Cross-chain Protocol- MAP Protocol

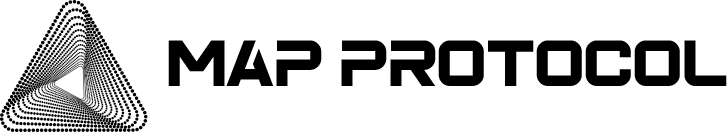

Recently, there is a new and promising player in the cross-chain field: MAP Protocol. Instead of using MPC i.e. PEOPLE to facilitate the transfer, MAP Protocol uses the MAP mainnet, i.e. BLOCKCHAIN to safeguard assets transfer. It is a truly decentralised cross-chain protocol and is developed to escalate the security level of asset transfer among multiple chains via an unique and reliable trustless mechanism realised in the following design:

- Fully EVM compatible blockchain “MAP Chain” lays a solid foundation which is secured by 100+ staked validators via BFT protocol.

- Bulletproof smart contract named “Assets Vault” manages massive cross-chain assets by automation.

- Cross-chain verification is accomplished by the Light Client Protocol.

- Light clients are updated by 1000+ Relayers with cryptographic proof following consensus.

- Fair and unbiased on-chain randomness is supported by massive Relayers in the swarm model.

MAP protocol shares many similar features of Polkadot and Cosmos, i.e. rely on cryptographic proof rather than trusted relayers when verifying cross-chain messages, facilitating cross-chain transfer, and cross-chain swap, the dedicated MAP Chain also adopts Proof-of-Stake and Byzantine Consensus just as Polkadot and Cosmos. Yet, the most significant difference is that Polkadot and Cosmos have been focusing on connecting isomorphic chains within their own ecosystem. This explains the current isolation state of both realms from the flourishing EVM world. MAP Protocol starts the journey from connecting heterogeneous blockchains. With a dedicated underlying MAP Chain, it can easily build connections with other blockchains and have the capability to expand. MAP protocol has a real potential to become the first truly decentralized cross-chain protocol.

MAP Protocol also has recognised by the industry. Since 2019, MAP Protocol has formed a strategic partnership with Microsoft Azure, and are invited to be on the Technical Board of IEEE Computer Society Blockchain and Distributed Ledger Standards Committee, the most prominent technology organization in the world, to contribute in developing relevant international standards. MAP Protocol also received an investment from Softbank Singapore, one of the largest Venture Capital companies in the world.

With Bitcoin replacing gold as the new safe haven and other cryptocurrencies replacing US dollar as a proof of value, MAP Protocol is expected to replace existing cross-chain bridges and become a new “SWIFT” system for blockchain-verse. The days when blockchain residents move and exchange assets securely, freely and instantly across any blockchains are coming.