“Map Protocol enables secure and seamless cross-chain communication and asset transfer between both EVM and non-EVM chains with its mature, novel, and stable cross-chain design. The relay chain architecture not only allows for multichain scaling but also avoids the risk of insecure cross-chain messages. What is more, the unique zero-knowledge-proof-based light client design not only reduces the difficulty of heterogeneous chain development but also ensures the security of cross-chain message transmission. Given MAP Protocol’s compatibility with almost all blockchains and its support for native deployment of dApps on relay chains, it will become an essential component of cross-chain applications and can very well become instrumental for cross-chain technologies’ future.”

Professor Liu Yang, Director of NTU Cybersecurity Labs

Multiple L1 ecosystems are and will be expanding. While Ethereum remains the leading L1, it cannot be the one-size-fits-all solution to emerging blockchain needs. Hence, in this ever-changing multichain future, the need for cross-chain interoperability is essential for Dapps to retain stability and continuously expand its ecosystems. This is also why projects in the cross-chain interoperability vertical remain very popular among many investors even in this market.

As of October 2022, there have been more than 100 cross-chain bridges, among which the cross-chain bridge Stargate based on LayerZero has a TVL surpassing $450 million. Compared with the previous leading cross-chain bridges such as Multichain, LayerZero took a novel approach toward efficiency and composability. However, the reliance on off-chain oracles, more specifically, Chainlink, sacrifices a large degree of decentralization and security, adding an extra layer of the vulnerability of oracle dependency risks and relayer collision risks. Especially when Chainlink has been exploited previously (see below for details).

“As a team of devoted believers of being 100% compliant with Satoshi Nakamoto’s consensus mechanism and firm believer of provable security, MAP Protocol spent four years in research and development to solve the biggest cross-chain technology bottleneck — that light client cannot verify across blockchains among heterogeneous chains or is inefficient in doing so, and successfully developed MAP Protocol — a fully decentralized, interoperable, composable, scalable, and efficient omnichain protocol with full-chain coverage and provable security built upon light client and Zero-Knowledge (ZK) technology.” —James Cheng, Co-Founder of MAP Protocol

MAP Protocol’s Relay Chain mainnet went live at the end of August 2022 and is targeting to cover NEAR, BNB Chain, Polygon, ETH2.0, and Klaytn by the end of the year with many other L1s and L2s to follow. Currently, the MAP Protocol team is preparing a series of omnichain programs open to developers and communities aiming to fire up the landscape of a seamless cross-chain of tokens, data, messages, and NFTs. This will also enable a paradigm shift of many existing web3 verticals such as decentralized identity (DID), decentralized derivatives, and GameFi, empowering Dapps to tap into the users and resources in different blockchains.

In this multichain future, omnichain infrastructure is arguably a more important scaling solution than L2s. For example, Dapps’ performance can grow exponentially based on the transactions per second (TPS) of covered blockchains, no longer being limited by the single-chain’s TPS. Thus, for both developers and users, the MAP Protocol omnichain infrastructure is something worth paying attention to.

01 Overview

Let’s dig deeper into MAP Protocol and see why I think this project which took 4 years in research and development, is worth looking into.

The provably secure omnichain infrastructure

Inside this omnichain network, signature algorithms, merkel tree proof, and hashing of major L1s are precompiled to the MAP Protocol’s Relay Chain layer. This clever and unique design, and their independently verifiable light clients, which allows MAP Protocol to be the only cross-chain infrastructure that is provably secure and able to connect to all EVM and non-EVM chains with instant finality. For developers, their projects can be deployed and connected to on all chains which MAP Protocol supports efficiently and securely through their SDKs and integration supports.

Continuous cost reduction

Currently, MAP Protocol only charges gas fees on MAP Protocol’s Relay Chain with no additional service fees. The team is also continuing to lower the chains’ gas fees by further refining their light client verification methods through ZK. MAP Protocol’s effort on continuous cost reduction will help end users in saving cross-chain costs and empower omnichain Dapps building on MAP Protocol to be cost-efficient.

100% compliant with Satoshi Nakamoto’s consensus mechanism

Light clients, the verification components, deployed on MAP are independent and self-verifying smart contracts. The whole cross-chain verification process does not depend upon any off-chain verification or any specified third-parties. Instead, it is fully decentralized and 100% compliant with Satoshi Nakamoto’s consensus mechanism.

Unlimited ecosystem expanding potential – omnichain data and omnichain NFTs

MAP Protocol’s cross-chain capabilities are not limited to token bridging. All data on L1s and L2s can be bridged from one chain to another on MAP Protocol via on-chain oracles. Compared to off-chain oracles (the current mechanism for data to move from one chain to another) on-chain oracles can provide tamper-proof and provably secure cross-chain data to ensure the accuracy of data.

The solution to omnichain NFTs provided by MAP Protocol does not utilize the “minting+burn” mechanism that the other existing NFT bridges utilize. Instead, their mechanism is based on bridging the ownership and usage rights of NFTs. This innovative approach in omnichain NFT will unleash the true power of multichain DID, on-chain derivatives, SBTs (soul-bound tokens), and GameFi.

02 Background of Omnichain

“Cross-Chain” and “MultiChain” Explained

Before we get into cross-chain and multi-chain, let’s talk about blockchain interoperability.

All blockchains are independent ledgers. Each chain has its own consensus mechanism, data structure, security algorithm, and ledger type, thus making it difficult for them to talk with one another. Interoperability aims to resolve communication silos, allowing different blockchains to communicate and interact so that users can send information, metadata, and assets from one chain to another.

Cross-chain, transferring assets or data from one chain to another, is an important mechanism for users to achieve interoperability but the current cross-chain platforms are very fragmented and limited with many merely focusing on token crossing. On the other hand, multichain is an ecosystem where multiple chains are connected. With the increase of L1s, the current multichain solutions in the market which connect several chains, still leave the whole blockchain space fragmented. Further, the ongoing hacks on cross-chain bridges throw the security of existing cross-chain infrastructure into question. Hence, both the existing cross-chain and multichain solutions in the market cannot fully solve the interoperability issue.

The Future of Multi-Chain — Omnichain

To resolve the conundrums in the existing cross-chain and multichain verticals, a new interpretability model — omnichain — is born. Omnichain is the future of multi-chain. It can allow Dapps, protocols, and users on different blockchains to interact with each other seamlessly and securely, which is key to the growth and mass adoption of Web3. The future of multichain being omnichain is inevitable for the following reasons:

- The growth of multiple L1s

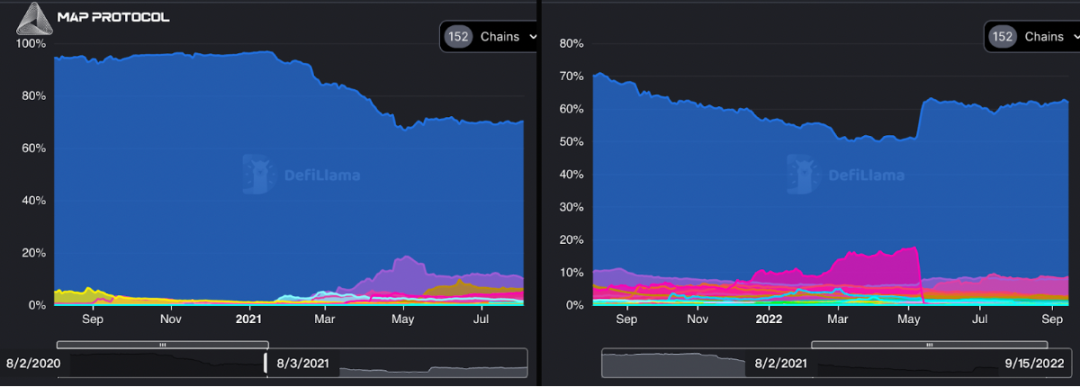

People’s view on L1s is heavily influenced by the market. In the bear market, people tend to be more pessimistic, believing that among all the L1s, only Ethereum can survive. Yet in the bull market, people tend to be overly optimistic, believing that any L1s can thrive and grow. If we look into the data of all major L1s, we will agree that multiple blockchains will be the future.

From the diagram above, we can observe that from August 2020 to September 2022, although Ethereum still has the largest TVL, the TVL on other L1s has increased. Therefore, even though the other L1s cannot be the Ethereum killer at the moment, their ecosystem have been growing. For example, the number of Dapps and services and Daily Active Users (DAU) on BNB Chain has surpassed the number of DAU on Ethereum. With the growth in these multiple L1s, an EVM and Non-EVM inclusive omnichain ecosystem will be the future of Web3.

- Dapps’ need to grow on multiple chains

According to DappRadar, there are 12,670 dApps in total on the top L1s and L2s it supports. Due to the congestion and high gas fee on Ethereum, around 75% of Dapps are on chains that are more developer-friendly with lower gas fees such as BNB Chain. However, Ethereum still holds the largest user base and assets. Dapps on other chains, including non-EVM chains, still hope to tap into that large user base and resource. To do that, they can deploy their application on multiple chains, but here come several problems: (1) assets on different chains cannot move freely; (2) ledgers are divided; (3) users will be less willing to stay due to complicated multiple address processes and high gas fees.

In this context MAP Protocol’s omnichain network will allow Dapps to tap into the maximum amount of user and resources on different chains, while maintaining a holistic omnichain ledger. At the same time, user experience will also be streamlined and simplified.

- Ethereum’s computation limit

From the evolution of computers, we’ve learnt that any single computer has its computation limit, no matter how much a computer increases its computational capacity. As the “world computer”, Etheruem is expected to further increase its computational capacity through the upcoming sharding, raising its TPS to 100,000. However, its computational bottleneck still exists. To onboard most if not all web2 users and products onto Web3, the only feasible strategy seems to be increasing the overall computing capacity together with other public blockchains.

- Web3 cloud computing infrastructure

As the number of on-chain users increases and as more bots and devices interact with on-chain smart contracts, or putting this hypothesis to an extreme, let say if all web2 users are migrating to web3, without sacrificing the speed they enjoyed in Web2, the whole TPS for web3 blockchains would need to be around dozens of billions. To achieve that, many L1s needs to work together to form a cloud computing architecture similar to cloud computing in web2. At that time, an omnichain network such as MAP Protocol will be needed to serve as a cloud computing highway to seamlessly allocate computing resources across blockchains for transaction requests from Dapps. Therefore, the value for omnichain network will continue to increase as web3 grows.

Existing Cross-Chain Technologies

Before we get to omnichain, let’s go through the basis of omnichain — the different cross-chain technologies. As a distributed ledger system, the core of blockchain is decentralization and the elimination of privileged intermediaries. The key in achieving that is recording the ledger with a chain structure to ensure that the results are traceable and non-tamperable. The essence of cross-chain is ledger alignment, and the following are the three major existing technologies for ledger alignment.

*For the purpose of this article, decentralization is referring to distributed ledgers on blockchains confirmed using Satoshi Nakamoto’s consensus mechamism, in contrast to “private” ledgers managed by privileged parties utilizing a centralized cryptographic security mechanism.

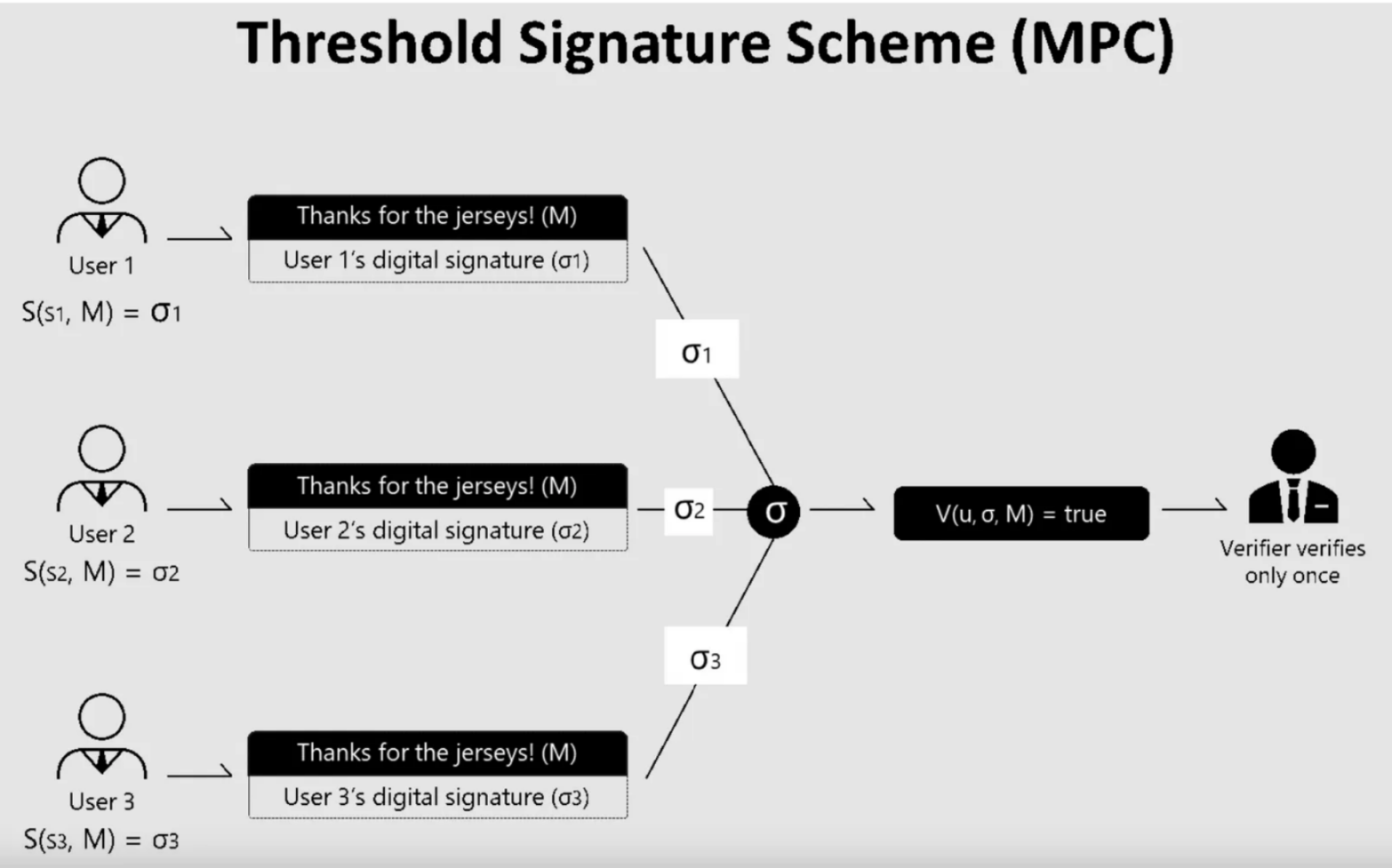

- Centralized Cross-Chain Technology – MPC

MPC is the acronym for Multi-Party Computation, a distributed computation technique in cryptography. Axelar, Celer (cBridge), Multichain, Wormhole, and Thorchain use this for cross-chain verification.

In this solution, a fixed or regularly rotating verifier consisting of several roles appointed by the project owner acts as the final confirming party for verifying of cross-chain transactions. This means that if a hacker breaks into the verifier’s server, the hacker can steal all the locked funds, or the project owner can steal the funds themselves. Since the existence of the privileged role cannot be eliminated, the whole verification process’s security rest on the hands of a few selected entities.

There are many variants of the MPC scheme, such as threshold signatures, or a validator rotation mechanism at MPC signature nodes, but none of these change the nature of MPC, a centralized cryptographic scheme. According to a report released by Chainalysis this August, cross-chain bridge attacks accounted for 69% of the total amount of cryptocurrencies stolen in 2022, a loss of $2 billion, with projects using MPC cross-chains bearing the brunt of the damage.

- Quasi-Decentralized Cross-Chain Technology – Oracle

Oracle is an off-chain infrastructure that links off-chain data to the blockchain. Decentralized oracles (such as Chainlink and Pyth) takes data and reconcile data from multiple sources on chain. This adds an extra layer of vulnerability especially when Chainlink has been exploited previously (Chainlink nodes were targeted in an attack last weekend that cost them at least 700 ETH – The Block, 4 Sept 2020) and Pyth has also had data malfunction (Oracle Pyth Goes Haywire on Solana with Bad Prices – The Defiant, 22 Sept 2021). Quasi-decentralized cross-chain solutions such as LayerZero uses these data from oracles for their cross-chain verification purposes.

Specifically, LayerZero uses oracles on Chainlink and relayers to check against each other for their cross-chain security. Although moderately safe, its whitepaper has also mentioned an extreme case: relayer may collude with oracle. While this risk is mitigated by the fact that oracles and relayer are supposedly working independently, the collusion risk between Chainlink nodes and relayers exists, and if it happens, the attacker can steal all the assets in the relevant pool.

In addition, cross-chain verification requires accurate data, but the data transmitted by the oracles can be ambiguous or not accurate, as mentioned above that both Chainlink has been attacked and Pyth has had malfunction previously, which can cause problems for the Dapps using LayerZero’s services. Also, although the design of LayerZero includes light clients, it is only for data verification happening on the same chain (more on light clients below). Hence, their cross-chain verification does not utilize light client techonology, but instead depends upon the quasi-decentralized oracles.

- Fully Decentralized Cross-Chain Technology: Light Clients’

Light clients or light nodes is the Simplified Payment Verification illustrated in Bitcoin Whitepaper. It is a light way to quickly verify the validity of a blockchain transaction. Because of its “self-verifying” capability and nature, utilizing light client technology in cross-chain verification process would allow cross-chain transaction verification to happen without relying on any specified off-chain third parties or quasi-decentralized oracles. Light client are not necessarily a client program. It can be a component or a smart contract. Projects that use light clients for cross-chain include MAP Protocol, Cosmos, Polkadot and Aurora (Rainbow Bridge).

For light client technology-based cross-chain verification process, the light client will be built into the chain or deployed to the chain as a smart contract. The block header information of chain A is updated by the inter-chain messenger to the light client of chain A on chain B. If there is a fake transaction from a hacker trying to cross from chain A to chain B, the transaction will not be verified by the light client as valid unless the hacker attacks the entire blockchain A as a whole. With light client being the core verification component in this cross-chain design, it would be impossible for a hacker to obtain a valid signature from validators on chain A, hence chain B will not accept such an invalid cross-chain request initiated by the hacker.

Further, any fake messages from inter-chain messenger will not generate a successful attack because all messages are verified by the light clients. To attack successfully, it would require the inter-chain messenger to at the same time attack the entire blockchain A to affect the light clients, which is nearly impossible.

Different from the light client design on Cosmos, Polkadot and Aurora (Rainbow Bridge), MAP Protocol does not only function inside their own homogeneous ecosystems. It can and aims to cover all major L1s/L2s including EVM and non-EVM chains. This is because MAP made the following technological breakthroughs:

- MAP Protocol’s omnichain network has pre-compiled the signature mechanism and hashing of the supported L1s/L2s as smart contracts so that these L1s/L2s (be it homogeneous chains) can be supported and bridged between each other through the MAP Protocol.

- Merkle tree proofs are precompiled in MAP’s protocol layer, so that cross-chain light clients can be deployed as smart contracts on the supported L1s/L2s to achieve cross-chain verification. In comparison, Cosmos and Polkadot cannot support heterogeneous chains such as Etheurem.

03 Product and Business Model

MAP Protocol

MAP Protocol is the omnichain layer of Web3 with light client and ZK technology as its core technology. Based on the light client cross-chain verification mechanism, MAP Protocol has successfully pre-compiled most major L1 signatures, hashing, and merkle tree proof onto MAP Relay chain’s virtual machine. Thus, upon launch, data on the supported chains be bridged seamlessly through MAP Protocol’s omnichain network. By introducing ZK technology, MAP Protocol further reduces cross-chain gas fees.

In a nutshell, MAP Protocol is the only omnichain infrastructure that can cover all chains with the highest security level in the market. For developers, MAP Protocol will largely reduce their cross-chain costs and multichain costs. For users, MAP Protocol safeguards their cross-chain assets with blockchain-level security while helping them reduce costs.

MAP Protocol’s Omnichain Network consists of three layers:

Business Model

- Protocol Layer — where the core of omnichain verification and communication happens

- The Protocol layer forms the base and the core of the omnichain network. It consists of MAP Protocol’s Relay Chain, light clients deployed on each supported chain, and inter-chain maintainers. MAP Relay Chain has successfully pre-compiled all supported L1s/L2s’ signatures, hashing, and merkle tree proof rendering the MAP Protocol’s Relay Chain a super machine that can speak all languages of the different blockchains.

- Through the MAP Protocol’s Replay Chain, different chains can speak with one another, which lays the solid foundation for all chains to become one omnichain network.Light clients deployed on each chain are independently capable of self-verification and have security finality.

- Together with the homogenous foundation built by the MAP Protocol’s Replay Chain, light client verification networks can communicate with each other, thus achieving a provably secure and decentralized cross-chain verification architecture.Maintainer is an independent inter-chain messenger responsible for updating the latest status of light clients and submitting block headers’ info on each chain as a transaction ultimately to the target chain.

- The pre-compiled smart contracts on MAP Protocol’s Relay Chain are unique in terms of its design. Compared with other cross-chain solutions based on light clients, MAP Protocol can cover all L1s and L2s. Combined with its unique cross-chain communication design, MAP Protocol allows different blockchains’ data and assets to move freely through one another.

- MOS (MAP Omnichain as a Service) Layer — fully empowering Dapp developers

- MAP Protocol’s Omnichain as a Service (MOS) LayerThe second layer on MAP Protocol is the MOS (Omnichain as a Service) layer.

- Similar to how Google Mobile Service is there to serve Android developers, the MOS layer is here to serve Dapp developers to allow them to build their omnichain Dapps on top of MAP Protocol. This layer consists of cross-chain vaults on supported blockchains and the inter-chain Messengers.

- Developers can directly utilize this layer to build their omnichain solution, and they can also further develop this layer and customize it based on their developmental needs. All the contracts on the MOS layer are open source and are audited by CertiK. Thus, DApp developers can build innovative and creative omnichain solutions efficiently and effectively.

- Omnichain Application Layer — the ever-expanding omnichain Dapp ecosystem

- The Omnichain Application Layer covers all the omnichain Dapps building on MAP Protocol.

- Take decentralized derivatives and synthetic assets as an example, currently, these Dapps are limited by the price and liquidity on the specific blockchain which they are deployed on. Moreover, quasi-decentralized oracles has its limit as to the accuracy and speed of data on different blockchains. Through MAP Protocol, these Dapps can obtain precise multichain data and their liquidities on different blockchains can be “combined” and move freely from one chain to another.This cross-chain technological breakthrough’s application is surely not limited to DeFi Dapps, other applications include omnichain DID, omnichain lending, omnichain swaps, Omnichain games, Omnichain DAO governance, and Omnichain NFT.

- The Omnichain Application Layer covers all the omnichain Dapps building on MAP Protocol.

Tokenomics

According to MAP Protocol, the total supply of its token $MAP is 10 billion. Based on the data on Coingeko in November 2022, the total market value of MAP Protocol is at 105 million and its circulation rate is around 20%.

- 15% are for developers of MAP Protocol, with a vesting period of 2019 to 2024. Given the fact that this project took off in 2019 while the token for the team will finalize its distribution in 2024, the locking period of $MAP token is longer than the majority of projects in the market.

- 21% are for Ecosystem DAO, not locked and fully decided by the MAP Community on how the token should be used. For MAP DAO governance, all major decisions that may impact community members need to be fully discussed on MAP forum and subsequently be voted on-chain.

- 12% are for MAP Foundation for building the initial state of the MAP Protocol ecosystem and the web3 omnichain ecosystem before it become fully decentralized.

- 22% are for its investors and early supporters.

- 30% are mining reward for validators on MAP Relay Chain, and Maintainers.

As a public infrastructure, MAP Protocol only charges gas fees incurred on MAP Relay Chain. In contrast, most other centralized cross-chain solutions based on oracles and MPC charge a service fee for processing cross-chain transactions. Hence, for developers, MAP Protocol’s fee model is more friendly.

04 Funding and Market Valuation

Fundraising

MAP Protocol did not raise any funds from venture capitals, but was directly listed on Bithumb after two years’ development, thus lacking any endorsement by well-known investors or investment institutions. Compared with LayerZero, which first gained recognition via Stargate and then backed by large VCs, MAP Protocol did not catch mainstream media attention and was focused on building. This hopefully would change soon as the MAP team revealed that they would support many top L1s by the end of the year.

The co-founder of MAP Protocol James Cheng once mentioned that when the team initiated MAP, Cosmos and Polkadot were headstrong. The team talked with several investors and investment institutions, but almost all of them suggested that MAP Protocol may need to consider giving up its cross-chain path, because Cosmos and Polkadot had already had probably the best solution for cross-chain interoperability. Instead of giving up, the MAP team decided not to seek support from investors but raised funds within the team for development.

Now it seems that both Cosmos and Polkadot are hampered by technical bottlenecks and product positioning, and their development momentum has been reduced. In comparison, the MAP team has built the product and is continuing to look for innovative ways to improve their product in solving the trilemma in the cross-chain vertical.

Market Valuation

Compared with other cross-chain projects, MAP Protocol’s market value is heavily undervalued.

05 Team

Technology-Focused Geek Culture

Founded in 2019, MAP Protocol was listed on Bithumb, a registered Korean exchange. Based on MAP Protocal’s history, it is clear that the MAP Protocol’s team chose to put time and effort into developing rather than a media show to investors. Also, before the launch of their mainnet, there was little media mention of their solid technology.

From the completion of MAP Protocol’s challenging light client-backed cross-chain technology that can cover all chains, the contracts that pre-compiled multiple signatures and hashing on their Relay Chain EVM layer, the well-developed omnichain design, its opensource Github code, and the further development of ZK cross-chain underway, it is clear that the MAP Protocol team consists of geeky engineers that is research-driven. The MAP Protocol team is a team led by technology-focused engineers and researchers, with more effort and resources spent on technological breakthroughs. Although the token launch is the most direct way to get native funding for Web3 projects, institutional investors does have the advantages on the project’s marketing. I hope that the MAP Protocol’s team will be able to partner with institutional investors in expanding its omnichain ecosystem.

06 Ecosystem

Mainnet and Public Chains

After almost four years of full-stack development, MAP Protocol’s Relay Chain was finally launched in August 2022 and major L1s will also be integrated at the end of this year, after which MAP Protocol will officially kick start its omnichain ecosystem plan.

Many well-known validators have joined the MAP Protocol’s Relay Chain network which includes Ankr, InfStones, HashQuark, Citadel.One, Ugaenn, Neuler, Allnodes, and many others. Major L1s/L2s such as NEAR, Flow, Polygon, Iotex, and Harmony, have expressed their endorsement to MAP Protocol’s strong technology foundation.

As of early November 2022, the integration of ETHW, Ethereum 2.0, NEAR, BNB Chain, Klaytn, and Polygon has entered the testing phase and started to be audited by CertiK. It is expected that all integration will go live by the end of the year. Integration with other major L1s and L2s such as Solana, Aptos, Sui, Iotex, Flow, Harmony, AVAX, Fantom, and XRP will also go live targeting the second quarter of 2023.

The current MAP Protocol ecosystem is focused in DeFi, GameFi, and on-chain data. Below are the top applications building on MAP Protocol.

Applications

Omnichain Payment – Butter Network

Butter is positioned as the Visa or Stripe payment gateway in crypto, aiming to offer a decentralized and seamless cross-chain payment solution to developers and users. Take NFT selling in GameFi as an example, due to limited supportive token types and cross-chain payment barriers, the total costs spent in bridging is often ranging from 30% to 50% of its total revenue. If omnichain payment is enabled, these costs can largely be avoided. Similar to the scenario in our fiat world, European tourists do not have to exchange cash but can use their European Visa card to pay at a Singapore restaurant, while the Singapore restaurant owner will still receive Singapore dollars.

Through the omnichain infrastructure provided by MAP Protocol, Butter has successfully built a fully decentralized and secure cross-chain liquidity exchange network. Together with Dapps for payments, Butter can offer a full suite of decentralized payment infrastructure services and greatly improve the convenience and user experience in GameFi, NFT selling, and on-chain/ off-chain ramps.

Gamefi Service – Plyverse

Plyverse is a platform for GameFi, serving both businesses and users. On the user side, based on big data technology and the power of DAOs, Plyverse provides GameFi players with a portal to select and rate games. It also provides NFT trading, game token trading and other GameFi-related features. It is worth noting that Plyverse has collaborated with Nanyang Technological University’s cybersecurity-related lab to conduct security ratings. On the business side, Plyverse offers a wallet SDK for GameFi developers. Because this wallet SDK has utilized MAP Protocol’s protocol layer, GameFi projects will be able to easily deploy their games on different chains and have access to data on different chains.

On-Chain Oracle – SaaS3

Traditional web3 oracles bridge the information in blockchains and the real world. However, these quasi-decentralized off-chain oracle consists of centralized security risks and data accuracy ambiguity.

SaaS3’s on-chain oracle aims to resolve this issue by transmitting real-world data and computing to the blockchain world in a decentralized, secure, and permissionless manner. Further, through MAP Protocol, SaaS3 can connect to all major L1s/L2s, allowing data on one chain to move around all chains via on-chain oracles. This will greatly help Dapp developers to easily deploy web2 APIs onto SaaS3’s serverless system and connect to their target chains.

ENS Service: Unstoppable Domain Unstoppable Domain (UD) is a Web3 identity platform, dedicated to help people create their uniquely owned NFT domain names and manage their digital identities better. By adding a word of their own choice with .x or .crypto suffix, users can create their NFT domain names and use it in their wallet. Up till now, UD users have registered over 2.5 million NFT domain names, among which 1 million of them are on L2 Polygon.

Although minting NFT domains certainly facilitated web3 users’ onboarding experience, in this multichain world, single-chain domain names still hold limited usage, nor can it meet users’ cross-chain needs. Thus, Unstoppable Domain is now collaborating with MAP Protocol to expand web3 domain name usage allowing their users to enjoy both the delight of interacting with NFT domain names and the convenience of secure cross-chain experience.

DID – Litentry

Litentry is the aggregate decentralization protocol in the Polkadot ecosystem, aiming to empower users to maximize their on-chain identity value by aggregating their personal data on web2 service providers, web3, and centralized service stage systems, while helping users preserve maximum privacy and pseudonym. DeFi lending is an impart use case of Litentry. By allowing users to log in and connecting data on different chains, users can sync their data on other chains to build their credit records. To fulfill this vision, MAP Protocol has partnered with Litentry to unleash the interoperability of cross-chain identity data, thus helping users to build their dynamic decentralized identity.

Wallet – BeFi Wallet

Built upon MAP Protocol’s omnichain network, BeFi Wallet is a secure multichain wallet for web3.0 Dapps including DeFi and NFTs. Users can send, receive, and store digital assets securely, and they can even use BeFi Wallet to buy, store, collect NFTs, exchange crypto, play web3.0 games and access the latest Dapps. The total number of users on BeFi Wallet has surpassed 700,000 and has a DAU above 20,000.

DAO – Clique

Built upon Verse Network, Clique is an innovative solution that offers one-stop DAO tooling. Via Clique, DAOs and projects on Ethereum do not need to transfer their tokens, but can directly participate in decentralized on-chain governance. Via MAP Protocol, Clique will be able to support more EVM and non-EVM chains and their tokens. Clique is also integrated with Klaytn and BNB Chain to further develop its existing community and Dapp ecosystem.

Community

MAP Protocol has a wide international community. Its Korean Kakao community has nearly 10,000 members, Telegram community 30,000 members, Turkish community 4,000 members, Russian community 3,000 members, and Vietnamese community 2,000 members. Overall, the MAP Protocol community seems most active in English, Korean, Turkish, Russian, Indonesian and Vietnamese-speaking countries. Some key community numbers include:

- Twitter – MAP Protocol’s account on Twitter was registered in 2019, but Twitter activity has only increased significantly after the mainnet launch. MAP Protocol Twitter currently has over 100,000 followers, with each tweet having a reach of over 5%.

- Discord – MAP Protocol’s Discord community only started earlier this year and has not yet reached 2,000 people, but the discord community is well managed. Judging from the Discord setup, the team will probably soon release a series of events for the community and developers to increase engagement.

07 Competitors

MAP Protocol has chosen a path of full blockchain coverage, supporting both EVM and non-EVM chains, in contrast with Cosmos and Polkadot, with only supports bridging between chains on their own ecosystems. Let’s start the competitor analysis with Polkadot and Cosmos.

Polkadot and Cosmos

We put Polkadot and Cosmos together based on their similar mechanics: (1) both have a L0 blockchain framework with application L1s built on their blockchain frameworks; (2) both only support interoperability between chains built on their framework; (3) their relay chains both do not support smart contracts and (4) direct decentralized interoperability with blockchains outside their ecosystems require modification of other L1s at the blockchain level.

As the early cross-chain projects, not a lot of L1s were present when Polkadot and Cosmas launched. Both of them developed their own blockchain framework — Substrate on Polkadot and Tendermint on Cosmos. By utilizing the blockchain framework, developers can quickly build their own L1 blockchains on Polkadot and Cosmos. Through their inherent cross-chain mechanisms, those L1s built on their L0s can connect with other L1s built upon the same blockchain framework via Polkadot Relay Chain or Cosmos Hub. Through this straightforward blockchain building and connecting process, Polkdadot and Cosmos has attracted a great number of developers and created a diverse ecosystem — over 100 Dapps and services are built on Polkadot and 263 on Cosmos.

However, top L1s and L2s not build on Polkadot and Cosmo cannot connect to chains on Polkadot and Cosmos, thus leaving Dapps built on these two ecosystems difficult to connect with users and assets on chains outside such as Ethereum. Aside from that, both projects are facing challenges in interoperability and growth:

- Neither Polkadot Relay Chain or Cosmos Hub has Turing Completeness, thus unable to compile smart contracts, which means that cross-chain developers cannot build native omnichain applications.

- Both require other chains to implant their cross-chain mechanism at the chain level. For other heterogeneous chains — that is, chains that are not built upon their framework, such as Ethereum, BNB, Klaytn, Polygon, and Avax — would need to modify its underlying blockchain structure to make it isomorphic to both, and then implant Polkadot/Cosmos cross-chain mechanism into these other chains to achieve interoperability. However, modifying the underlying structure is extremely complex, so there are no other major L1s/L2s connected directly with Polkadot Relay Chain and Cosmos Hub.

- Even if those other chains are willing to invest the required resources to make the change, to connect with Polkadot Relay Chain, for example, would mean giving the bookkeeping rights to the Relay Chain. This requires those chains to give their security to the Relay Chain, which will unlikely be unacceptable for other popular L1s/L2s.

- For Dapp developers, building on Polkadot and Cosmos requires building their own L1s first, and then deploying the Dapps on the L1 they built. Yet building an L1 is not always the core needs of most Dapp. Many of them would want to use the resource on covering more users and assets. From a cross-chain perspective, the development cost, learning curve and/or level of security risks, it is not cost-effective to build L1s on Polkadot/Cosmos first and then build to connect their users and assets to other external blockchains.

Therefore, although Polkadot and Cosmos use the light client cross-chain mechanism and maintain a high level of security, what they essentially did is built a huge closed internal ecosystem, without regard to cross-chain interoperability and Dapp ecosystem growth with external L1s/L2s. Both their design structure and technical mechanism make it difficult to interact with major blockchains such as Ethereum and BNB Chain. For Dapps, they can easily build their own chains on either Polkadot or Cosmos, but these two chains cannot meet the demands of connecting with more users and assets on other major blockchains outside of their ecosystems.

While bridges have become a topic of concern, there is one cross-chain bridge that has never been hacked — Rainbow Bridge. Built upon light client cross-chain mechanism, this cross-chain solution has guaranteed the maximum level of security. However, Rainbow Bridge built on Aurora (NEAR ecosystem) is lacking in connectivity and user convenience.

Currently, Rainbow Bridge only supports chain-chain from Ethereum to NEAR, and does not support other chains bridging to NEAR. In terms of supported tokens, NEAR’s Rainbow Bridge supports all tokens from Ethereum to NEAR, but only a few tokens back from NEAR to Ethereum. Also, due to Aurora’s lack of ed25519 pre-compiled contracts (which MAP Relay Chain has pre-compiled), Rainbow Bridge’s cross-chain solution from NEAR to Ethereum uses Optimistic validation instead of the automatic ledger alignment solution. The result is that a Rainbow Bridge cross-chain transaction would require a ~4-hour waiting period before it is confirmed.

LayerZero

As mentioned above, LayerZero’s innovative design is a better cross-chain mechanism when compared to the prevailing MPC’s cross-chain mechanism, which lowers the cross-chain costs. This also renders it a key player in the cross-chain space. However, as mentioned in its whitepaper, its oracle and relayer in their cross-chain mechanism may collude. Moreover, the level of security of their verification method, namely, ultra-light clients + oracle + relayer, cannot be proven. In this regard, Max Planck Society researcher Alexander Egberts mentioned in his research that the use of oracles is “two steps back from decentralization.”

Besides, using oracles will bring two problems: First, the oracle cannot feed precise data, which will be a great barrier for the development of on-chain data applications. Second, during cross-chain data transfer, oracles cannot support heterogeneous chains because they cannot resolve the engineering barriers in ledger alignment of heterogeneous chains. In today’s multi-chain world, LayerZero cannot guarantee provable security, thus lacking the secure technical foundation for Dapps.

However, in terms of market funding, LayerZero has strong capital appeal, backed by FTX, A16Z and other robust institutional investors. According to data on DeFi Lama, the TVL on Stargate, the cross-chain exchange application built on LayerZero, has exceeded $450 million. Thus, in terms of ecosystem expanding, LayerZero is a competitor that cannot be ignored.

08 Risks

Not Entirely Immune to Attacks

MAP Protocol is provably secure, 100% compliant with Satoshi Nakamoto consensus, and rely on independent self-verifying light clients. Compared with all the other cross-chain solutions, it is the best solution in terms of coverage, security and efficiency. However, this solution is not entirely attack-proof. Two possible point of attack is (1) MAP Protocol’s Relay Chain being forked, and (2) validators may turn against the blockchain.

Thankfully, the well-rounded security design of MAP Protocol can minimize those risks. Forking risk is minimized through setting trusted nodes. Validator acting dishonest risk is minimized through the requirement for validators to stake at least one million $MAP to become a validator of MAP Protocol. The risks will be further minimized as $MAP token gains value with the ecosystem growth. Overall, although MAP Protocol is not completely immune to attacks, it still has the most well-developed security mechanism among the existing cross-chain solutions.

The Existence of a Multi-chain World

A multi-chain world is the premise for the development and growth of an omnichain infrastructure. Hence, let say if one day one single L1 dominates the market, the need for cross-chain will disappear and so will the market for MAP Protocol. However, from the data illustrated above, as long as the congestion, high gas fee and processing limitation continue to exist on Ethereum and as the web3 needs continue to grow, the future of multiple chains remains inevitable.

09 Review

Bohao Tang, Dev Advocate of Flow commented on MAP Protocol’s omnichain expanding potential, “ MAP Protocol is helping Flow to b build the omnichain application infrastructure, which can achieve cross-chain verification without any privileged roles and cover both EVM chains and Non-EVM chains. We believe that MAP Protocol can certainly bring a more diverse ecosystem to Flow.”

Professor Liu Yang, Director of NTU Cybersecurity Labs, also believes that compared with other omnichain interoperability solutions, MAP Protocol has more solid security, better connectivity, and is more friendly to dApps:

“MAP Protocol’s mature, innovative and provably secure cross-chain design makes cross-chain communication and asset transfer secure and seamless. In contrast to Axelar, Celer and other centralized cross-chain solutions that do not utilize relay chains, MAP Protocol’s Relay Chain enables the expansion of multi-chain architecture, and avoids the risk of mischief resulting from super-admins controlling and manipulating interchain communication.

In comparison with Polkadot and Cosmos, which use relay chains to verify inter-chain messages, MAP Protocol introduces a zero-knowledge-proof scheme through the use of smart contracts. Besides eliminating the need for SDK embedding and structural compatibility across heterogeneous chains, this lightweight smart contract implementation also guarantees that interchain messages are transmitted securely and confidentially. This ensures compatibility and interoperability with almost all blockchains.

Moreover, Map Protocol’s innovative cross-chain design allows Dapps to be developed and deployed natively on relay chains. The docking of assets on each blockchain makes Map Protocol’s Relay Chain a crucial component of cross-chain asset and data exchange, and is expected to become essential for future cross-chain solutions.”

10 Conclusion

I believe that MAP Protocol has unbeatable advantages in cross-chain communication. It is the only cross-chain project that can achieve full-chain coverage and is 100% compliant with Satoshi Nakamoto consensus. It is also the omnichain infrastructure with the highest security, successfully solving the issue of control of selected third parties.

Thanks to the MAP Protocol team’s deep understanding and creative innovation in blockchain security and mathematics, as well as their technology-focused team culture and dedication in providing Dapps a more secure, efficient, and composable omnichain solution.

The omnichain infrastructure of MAP Protocol will officially go live at the end of 2022. As an omnichain infrastructure project with unique innovations and Dapp facing, the launch of MAP Protocol is expected to spark new innovations to the blockchain space; thus, it is a project worth paying attention to for both developers, investors and users.

11 References

- “Episode 93: Light Clients & Zkps with Celo.” ZK Podcast, 10 Aug. 2021,

https://zeroknowledge.fm/93-2/ - “Cross-Chain Bridge Hacks Emerge as Top Security Risk.” Chainalysis, 10 Aug. 2022,

https://blog.chainalysis.com/reports/cross-chain-bridge-hacks-2022/ - “LayerZero: Trustless Omnichain InteroperabilityProtocol” Zarick, Ryan, et al., 26 May 2021,

https://Layerzero.network/, andhttps://layerzero.network/pdf/LayerZero_Whitepaper_Release.pdf - “Bitcoin: A Peer-to-Peer Electronic Cash System” Nakamoto, S. (2008),

https://bitcoin.org/bitcoin.pdf - “Understanding the Blockchain Oracle Problem: A Call for Action”Caldarelli G., 2020; 11(11):509,

https://doi.org/10.3390/info11110509 - “The Oracle Problem—An Analysis of how Blockchain Oracles Undermine the Advantages of Decentralized Ledger Systems” Egberts, A., SSRN Electron. J. 2017.

* The original article is published on Hackernoon by TLDRDyslexic